Introduction: Navigating Bitcoin Taxes in 2025

Hey there, crypto enthusiasts! If you’re a US investor who’s been riding the Bitcoin wave, 2025 might feel like a rollercoaster—not just for market prices, but for tax season too. I remember last year when I first dove into crypto taxes; I was overwhelmed by the jargon and rules. But don’t worry—I’ve got your back! The IRS has been cracking down on cryptocurrency transactions, and with new updates rolling out in 2025, it’s more important than ever to stay on top of your Bitcoin tax game. Whether you’re trading, holding, or even using Bitcoin to buy your morning coffee, every move can have tax implications. In this guide, I’ll break down the latest 2025 IRS rules in a way that’s easy to understand, so you can file your taxes confidently and avoid any nasty surprises. Let’s dive in!

1. Bitcoin Is Still Taxed as Property—Here’s What That Means

The IRS has treated Bitcoin as property (not currency) since 2014, and that hasn’t changed in 2025. What does this mean for you? Every time you sell, trade, or spend Bitcoin, it’s a taxable event. Let me paint a picture: imagine you bought 1 BTC in 2023 for $40,000, and in 2025, you sold it for $75,000. That $35,000 profit is a capital gain, and you’ll owe taxes on it. The same applies if you use Bitcoin to buy something—like that new gaming console you’ve been eyeing. The IRS sees this as a sale, so you’ll need to calculate your gain or loss based on Bitcoin’s value at the time of the purchase.

Here’s a quick tip: keep detailed records of every transaction. I learned this the hard way when I almost forgot a small trade from two years ago—it nearly messed up my tax filing! Tools like CoinTracker or Koinly can help you track your transactions and make tax season less stressful.

2. New 2025 IRS Reporting Requirements You Can’t Ignore

The IRS has stepped up its game in 2025, thanks to the Infrastructure Investment and Jobs Act from 2021. If you thought you could fly under the radar, think again! Here are the big updates you need to know:

- Form 1099-B Reporting: Crypto exchanges like Coinbase and Kraken are now required to send Form 1099-B to both you and the IRS for all taxable transactions. This means every trade or sale is reported, making it harder to miss anything (or hide it, if that’s what you were thinking—don’t do it!).

- $10,000 Transaction Rule: If you receive more than $10,000 in Bitcoin in a single transaction—like from a big sale or payment—you must report it to the IRS within 15 days using Form 8300. This rule, originally for cash, now applies to crypto in 2025.

- Third-Party Wallet Reporting: Moving Bitcoin to a non-custodial wallet (like a Ledger)? Exchanges might flag this to the IRS, so don’t think self-custody means you’re off the hook.

I recently spoke with a friend who got a nasty surprise when he didn’t report a large Bitcoin payment he received for freelance work. The IRS sent him a letter, and let’s just say it wasn’t a fun conversation. So, stay proactive—report everything, and you’ll sleep better at night.

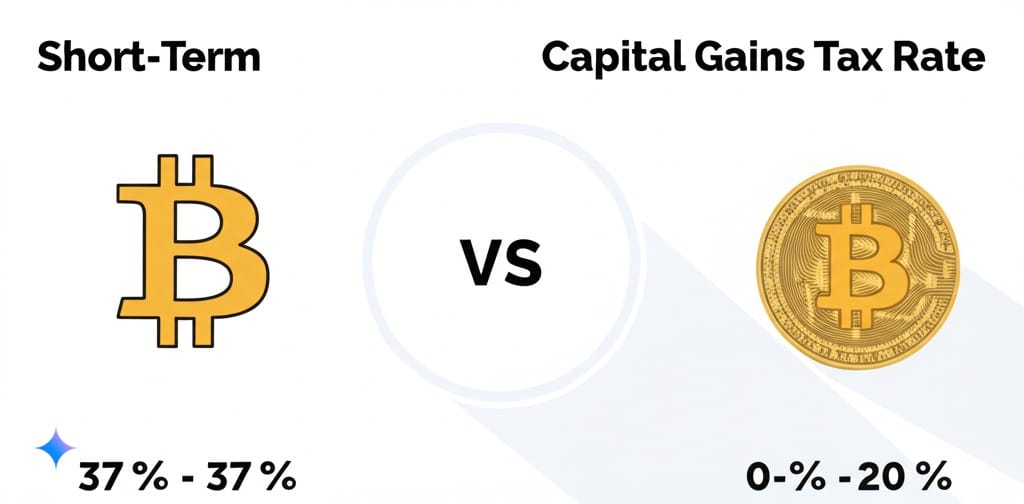

3. Capital Gains Tax Rates in 2025: Short-Term vs. Long-Term

Bitcoin gains are taxed as capital gains, and the rate depends on how long you’ve held your coins. Here’s the breakdown for 2025:

- Short-Term Capital Gains (held less than 1 year): These are taxed at your ordinary income tax rate, which can go as high as 37% if you’re a high earner. Ouch!

- Long-Term Capital Gains (held more than 1 year): These get a better rate, ranging from 0% to 20%, depending on your income. For example, if you’re a single filer with a taxable income under $47,025, your long-term gains are tax-free at 0%. If your income is higher, you might pay 15% or 20%.

Plus, if your adjusted gross income exceeds $200,000 (single) or $250,000 (married filing jointly), you might also owe the Net Investment Income Tax (NIIT) of 3.8%. I always tell my readers to hold onto Bitcoin for at least a year if possible—it can save you a ton on taxes. Want to learn more about tax-saving strategies? Check out this guide on crypto tax planning for US investors from the IRS—it’s a lifesaver!

4. Tax Loss Harvesting: Turn Losses into Wins

Not every Bitcoin trade is a winner, and 2025 might have seen some dips that left you in the red. But here’s a silver lining: you can use tax loss harvesting to offset your gains. For example, if you lost $5,000 on one Bitcoin sale but made $10,000 on another, you can deduct the loss, bringing your taxable gain down to $5,000.

Here’s a little-known trick: unlike stocks, the IRS doesn’t apply the “wash sale” rule to crypto (at least not yet in 2025). This means you can sell Bitcoin at a loss, claim the tax benefit, and buy it back immediately without waiting 30 days. I did this last year during a market dip, and it saved me a few thousand dollars on my tax bill. But word on the street is that the IRS might close this loophole soon, so take advantage while it lasts!

5. Staking and Airdrops: New 2025 IRS Guidance

If you’re into staking or airdrops, the IRS has some fresh 2025 guidance for you:

- Staking Rewards: If you stake Bitcoin (like through wrapped Bitcoin on Ethereum), your rewards are taxed as ordinary income at their fair market value when you receive them. So, if you earned $1,500 in staking rewards in 2025, that amount gets added to your income for the year.

- Airdrops: Got some free tokens through an airdrop? They’re taxable as income when you gain control of them. For example, if you received an airdrop worth $800, you’ll owe taxes on that amount, even if you don’t sell the tokens.

I remember getting excited about a small airdrop last year, only to realize I owed taxes on it. It was a bummer, but now I make sure to track every airdrop and staking reward. If you’re looking for a deeper dive into staking taxes, I recommend this detailed blog on crypto staking taxes—it’s packed with helpful tips.

. How to Stay Compliant and Avoid Penalties

Tax season doesn’t have to be a nightmare if you’re prepared. Here are some practical steps to stay compliant:

- Keep Detailed Records: Track every Bitcoin transaction—dates, amounts, and fair market values. I use a spreadsheet, but apps like CoinTracker can automate this for you.

- Report Everything: Use Form 8949 to report your capital gains and losses, then transfer the totals to Schedule D of your 1040 tax return.

- Consult a Tax Professional: Crypto taxes can get tricky, especially with new rules in 2025. A CPA who knows digital assets can save you from costly mistakes.

Last year, I tried to do my taxes alone and missed a few transactions. My accountant caught the errors just in time, and I’ve never skipped professional help since. If you want to connect with a crypto tax expert, check out this list of top crypto accountants in the USA—it’s a great starting point.

Conclusion: Stay Ahead of the Tax Game in 2025

Bitcoin taxes in the USA for 2025 are no joke, but they don’t have to be a headache either. With the IRS tightening its rules and exchanges reporting directly to them, staying compliant is non-negotiable. By understanding how Bitcoin is taxed as property, keeping up with new reporting requirements, and using strategies like tax loss harvesting, you can navigate tax season like a pro. I’ve been through the crypto tax grind myself, and trust me—being proactive makes all the difference.

What’s next? Stay tuned for our upcoming post on the “Top 5 Bitcoin Wallets for US Investors in 2025” to keep your crypto safe and secure. Got questions about Bitcoin taxes? Drop them in the comments—I’d love to hear from you!